THB #750: Why The Paramount Purchase Of WBD Is Likely To Disappoint, Pt 1

When Has This Ever Worked?

I have been stewing on this since the news broke on Thursday that David Ellison’s Paramount might buy Warner Bros Discovery with a “majority cash bid,” which has been often alternately reported, perhaps misreported, as a 100% buyout although the entire thing is still somewhat speculative.

On Thursday, I ranted about it for over a half-hour on David Reads The Trades and then I invited Richard “The Ankler” Rushfield on the show on Friday to rant about it will me some more.

It’s been marinating some more, pushed further for me by Roy Price, former master of the Amazon TV domain, resurfacing his position that this merger would make sense. Reading Roy’s piece, which makes a lot of assumptions about the paired company that I think have been proven to be historically and most likely false, was a good clarification for me of why I find this potential merger to be the most destructive in the long history of the industry and the short history of Streaming.

So… now I am going to try to offer a simple list of reasons why this doesn’t actually make sense… aside from possible ulterior motives for the Ellison family. Let’s start here…

When Has This Ever Worked?

Disney bought Fox’s film and television production operations and Fox’s one-third of Hulu and some of its cable channels and international platforms and accompanying rights for around $70 billion. And dumped a lot of it.

Aside from rights branding (for IP that is primarily being made by Disney proper), 20th Century Studios has averaged 3 films a year released under Disney in the last 3 years. Searchlight has released a few more films each year under that banner and operates on a somewhat different track than “Big Disney.” … though the arthouse division has been engaged in television production for the first time, starting even before the Disney merger was official. Nothing nefarious there, just what started happening everywhere with the opening of Streaming channels.

Lots of people - including me - have a lot of different takes on how much Disney overpaid for the Fox assets. My number is about $20 billion, but that is as much a function of timing (they bought at the top of the market pricing) and the need at the time for a major library purchase… much. more so than I see in the idea of Paramount merging with Warner Bros Discovery.

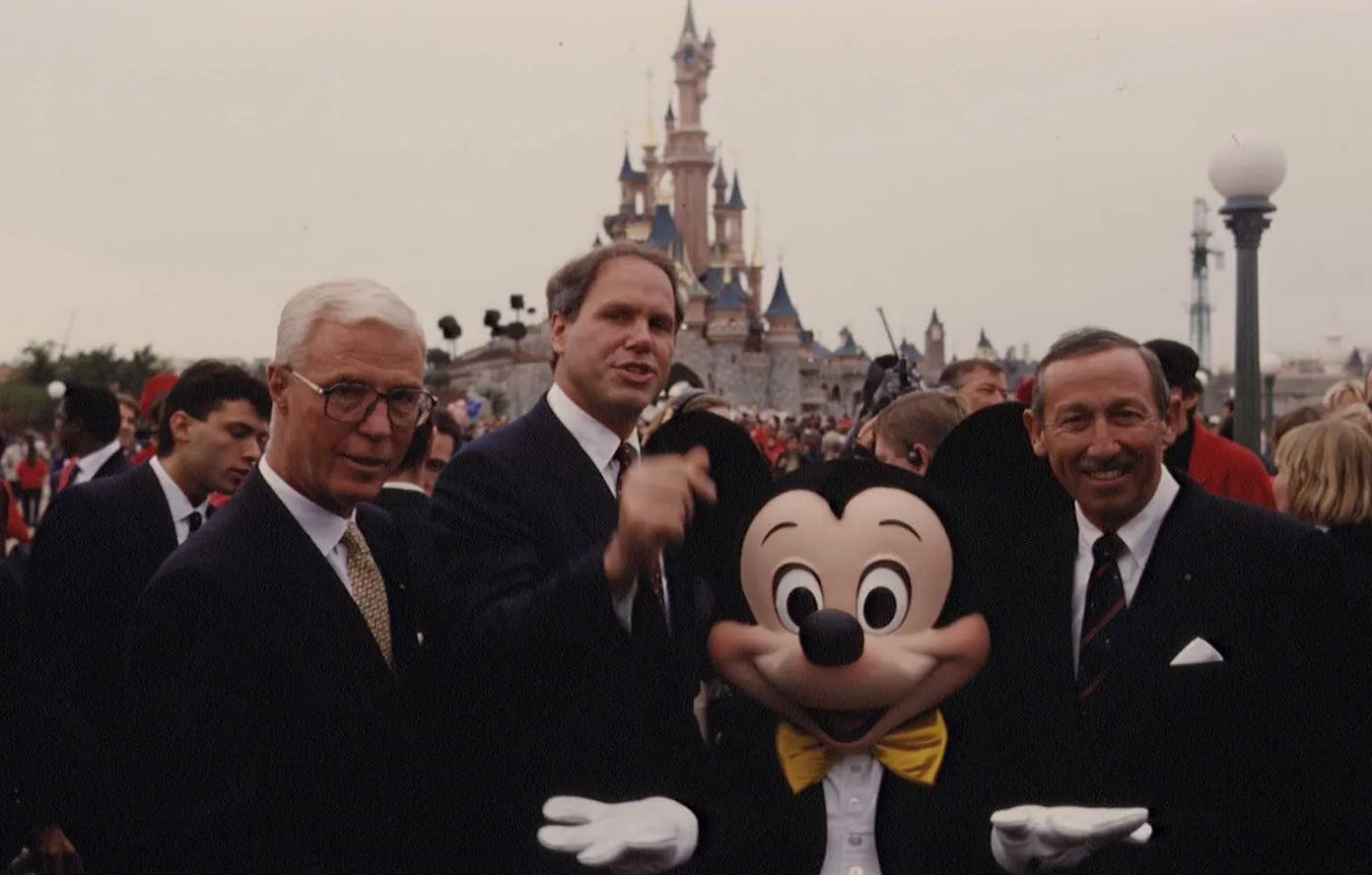

People forget that Disney was not the Disney we now think of today at all until Eisner and Katzenberg arrived in 1984. That’s 41 years ago now, but in LibraryTime, its not so long. And the “funny” part is that those 21 years of the Eisner-reinvigorated Disney movie history is somewhat forgotten, aside from the game-changing animation library and some select hits. I’m not going to spend the hours needed to really research this properly, but a high percentage of the films of Eisner and Katzenberg’s era at Disney (represented by Silver Screen Partners I - IV, which last funded a film in 1991) are not on Disney+ or Hulu, have little or no Blu-ray or 4K physical media footprint. You can rent or buy them on Streaming, but too often in bad quality reproductions. The point is, they are not highly valued by the company (which I consider a major misstep).

On the TV side, Eisner acquired Cap Cities/ABC in 1995… and Cap Cities owned a cable business known as ESPN. So Disney was deep into television and expanded its in-house television production side significantly as well, then within the inhibitions of syn-fin. ABC had been in business since 1965 and really became an equal to NBC and CBS by the mis-70s.

Pixar started distributing movies through Eisner’s Disney in 1995, but it wasn’t until he left in 2005 and Iger took over that what we know as the modern Disney started emerging. Iger closed the Pixar deal that Eisner just couldn’t. Then Marvel in 2009. Then LucasFilm in 2012. This has become the core of the motion picture model at Disney, along with Disney Animation, which was reinvogorated under the expanded portfoloio of Pixar whiz’s John Lasetter.

The Fox library expanded the range of the Disney library, which was needed as Disney expanded into Streaming, a variation on what people think of as Netflix spending heavily to build a library where there was none. It also gave Disney a controlling interest in the eldest high-profile Streamer, Hulu, though Hulu was a very different model at the time than Netflix would develop.

The point is that even though the Fox acquisition was mostly horizontal, giving depth to mostly the same business models and elements that existed in both companies to compete in the Streaming universe they were just joining, there was a real sense that relatively young Disney needed the Fox library as well as the Fox television apparatus (and talent) to compete at the highest level as a streamer moving forward.

I believe strongly that the first Trump presidency was the only administration in the last 50 years that would have approved the Disney purchase of Fox with as few requirements for divestiture as were made. Why? Simple. Murdoch and Fox News was very much a part of making Trump viable in national politics. Trump is, historically, loyal only to those who do things for him (and can continue to do things for him in future).

The question of the timing of this move by Ellison’s Paramount seems clearly attached to the 2nd Trump presidency and the willingness of Larry Ellison’s friendship to clear the way for another industry-damaging merger that will at the very least cost thousands of jobs, has the potential to cost 10s of thousands of jobs, and could both simultaneously force affiliated businesses to suffer and eliminate competition for a developing (or not developing) oligopoly.

When you look at the suggested Paramount/WBD merger, you look at 2 companies that have a very similar set of assets. The argument, which I will address later in this series of articles, is that more of the same for the combined company would be a game changer. But history has not proven this to be true… if anything, the opposite.

The only outstanding thing that Paramount has which Warner Bros Discovery does not is a Broadcast network with a major NFL deal (and some other sports rights, particularly international). The only thing that WBD has which Paramount does not is… uh… uh…. yeah!!!! IP.

The history of IP M&A takes us back to Disney most prominently. Disney became an almost completely in-house IP company for many years - still mostly there - with Pixar, Marvel, LucasFilm, and the already0existing Disney Animation. That model is still in place and will likely win 2025 as it won 2024 and so many year before. But the question that has risen is the diminished return on investment on this IP, including a too-long-empty Star Wars theatrical window signaled by the end of the Skywalker Saga, the end of the explosive cycle of the first Avengers-connected titles, and Pixar rebuilding after being undermined badly by Chapek and internal shifts in leadership with COVID as an excuse. Disney has indeed had massive success with the top Fox IP, like Avatar and… well… Deadpool… that’s 2!!!

There have been 20 $1 billion+ worldwide grossers since the deal with Fox closed at Disney. 12 of the 20 have been released by Disney. Only 2 of those 12 were Fox properties.

I don’t mean to to give the impression that I think Disney/Fox was a bad acquisition. I don’t think it was. It had some very specific goals and it has, for the most part, worked… especially on the TV side, in which Disney embraced what the Fox assets brought much. more so than on the film side. It’s worth pointing out, however, that the Disney flywheel includes Parks and a massive merchandising element that was there before the acquisition and has grown further with the added IP… an advantage no one else can really be expected to exploit at the same level as Disney.

That said, I guess that story is simpler/better than the 20+ years in the wilderness that Universal/NBCUniversal spent on its journey that started with Lew Wasserman deciding it was time to get out.

1990 - Matsushita Electric

1995 - Seagram’s

2000 - Vivendi

2004 - GE

2011 - Comcast

As it worked out, the synergies with Comcast have worked out pretty well for these last 14 years. The magical integration, driven by what everyone (like AT&T) thought was a need for a fully integrated telco/internet company, never really happened. But Comcast has been a good steward of the NBCUniversal business and Comcast proper has been bolstered by its internet provider business more than anything else.

But none of the 5 owners over the last couple decades were in the same business as Universal… though GE ended up “contributing” the NBC part… but because that other acquisition didn’t fit GE’s corporate focus.

As an adjacent business, Comcast has not given up on NBCUniversal and throw it back. Nor have they been as aggressive as some of the other corporations about chasing growth. Not like the idea of merging Paramount and Warner Bros Discovery. But they have continued to build NBCUniversal even though the crossover value to the rest of Comcast mostly turned out to be a mirage.

News Corp took over 20th Century Fox in 1985 and has controlled it - selling off bits of it and ultimately the large chunk to Disney - for the 40 years since. When the company wanted to expand, it invested in that expansion… primarily with the Fox television network. The News Corp newspaper business aside, the company has never really been acquisition-for-growth focused. In fact, they have been more willing than many to dump stuff that could be sold at a premium. Fox felt the urge and acted on selling off cable channels, like Fox Family Channel (becoming ABC Family and now Freeform), getting an outsized price for it from Disney in 2001.

Sony Pictures, nee’ Columbia Pictures, had Kirk Kerkorian, who had already taken control of what was MGM, trying to buy the studio in 1978. Columbia shook it off. But Coca Cola bought the company, which then expanded though small acquisitions and partnerships during their ownership, in 1982. Then they sold the whole thing to Sony in 1989. So obviously, it didn’t work for Coke. The initial interest from Sony was not wildly unlike the urge to merge for the sake of Streaming… the notion was that the entertainment hardware company would be advantaged by controlling the “software” aka the movies and tv shows. Sony had basically lost the battle of the VHS, a widely licensed hardware format vs Sony’s proprietary BetaMax around 1981. Buying Columbia was one more futile swing at reversing their fortune in this hardware. Sony would keep making the BetaMax until 2002, but by the mid-90s, their share of the market for videotape machines was under 15% and still dropping.

Speaking of Kirk Kerkorian, he first bought the MGM assets in 1969. He sold parts of the company over the years but then added UA in 1981. Then in 1986, he sold MGM/UA to Ted Turner. Turner sold it to Giancarlo Parretti in 1990. Then Parretti went bust and ended up selling it (back) to Kerkorian in 1996. Kerkorian expanded the business just enough to sell it again, to a consortium led by Sony, in 2005. But that didn’t take well and MGM went independent again in 2006. In 2010, MGM filed for bankruptcy. Under the Spyglass team, the company started pushing out movies again in 2011 and eventually, in 2021, the company as it is, was sold again, to Amazon.

Amazon has had a much clearer interest in building out the TV side, only fully committing to the theatrical movie business in the last year and change. The piece of mega-IP is Bond. But even here, Amazon was operating Prime and creating content, television and indie film, before MGM. But as limited as MGM was when they acquired it, it was a much more established entity than Amazon entertainment, not a merger of similar or similar-sized entities. The question of how this works out, even with Amazon having somewhat unclear standards for success, is up in the air.

Sumner Redstone acquired Viacom in 1987 and Viacom acquired Paramount from Gulf & Western (the owner since the early 70s) in 1994. In 1999, Viacom added CBS to its list of entertainment companies. Just 6 years later (2005), the decision was made to split the company because the stock of the combined company was not performing as they hoped. That lasted 14 years, during which neither stock ever really grew as hoped.

But also in 2005, Paramount “purchased” DreamWorks SKG for $1.6 billion, parking another $900 million for the DreamWorks library with a George Soros holding company, which it would have to repurchase the library from a few years later. Almost like a comedy routine, it turned out that Paramount, which never really expanded its theatrical output after acquiring DreamWorks but rather handed the bulk of its release schedule to DreamWorks to produce, had not secured the DreamWorks team on which it had become so deeply reliant… or even the name, DreamWorks.

3 years after The Purchase (2008), Team DreamWorks returned - they never really left - to The Amblin Adobe at Universal with outside funding from the Indian company Reliant and Universal as their distributor. Paramount was left with a studio that, on the production side, was a shadow of its SKG self and never really built a serious film studio under Brad Grey before his too-early passing in 2017. Since then, they have been stuck in the a malaise, in some part from Sumner Redstone losing his mind to illness and in the rest, from having Sumner-trusted leadership that was more into treading water than pushing forward. In 2019, CBS was reincorporated with Paramount/Viacom and the result was Paramount Global. Since 2003 or so, they have been working to get Sumner’s daughter out (at her request) and to sell it all to David Ellison.

And now… Watner Bros. The “glory days” since the end of the studio system have really been defined by an owner who bought the studio with assets earned from funeral homes, parking lots, and rental cars. Steve Ross bought WB for just $400 million in 1969. By the time he passed in 1992, he had led the creation of a media empire, experimenting in almost every area of the industry imaginable along the way, like Atari and Six Flags, some working and many not.

The first merger that didn’t quite work out so great was with Time, Inc. in 1989. Not a disaster, but it never lived up to its ambitions. In 1996, there was a merger with Ted Turner’s assets. Then, in 2001, the disastrous AOL take-over. Though the AOL name was stripped from the company, there was an interdependence until 2008. The television production studio was doing great. The theatrical company, led by Harry Potter and then Batman, was doing great. And then came AT&T in 2018. Another bad match. By 2022, AT&T was pushing the Warners assets into the new company, WBD, that would carry a ton of debt off the AT&T balance sheet and while still offering some upside, removed a lot of the downside.

So my friends… aside from a lot of people saying it a lot of ways in a lot of circumstances, has a media merger between 2 similar companies every worked in the 50 years post-studio system? No.

Has a merger between companies trying to grow by adding a company of a similar size and with a similar portfolio worked? Well, you could argue Disney. But as noted earlier, Disney was trying to fill a very specific sets of needs and overpaid to do it. (Not to mention another $8 billion to Comcast for the last third of Hulu, which they are using, but could really have built without the brand.)

If you told me WBD was trying to buy Paramount, that would make more sense… or at least some… because WBD is without a broadcast network and even though a bunch of people talk about linear tv like it’s dead in the water, the business world keeps saying this is false. (There was one such misguided trade writer on CNBC this morning, who not only failed to make a coherent argument, but also got existing facts wrong. Oy.) CBS has a lot of good things about it for Team Ellison and would similarly allow WBD a whole new quiver full of arrows. But that is not what’s happening.

Finally, closing this chapter with more to come… a lot of the enthusiasm out there for the Ellison Future requires buying into his bravado. But this is a weak spot for entertainment journalists. This is why crazy people are still talking about Apple buying a full-service studio… or really Amazon, who bought the whole of MGM/UA for 1/4 the current estimated value of WBD, which was also Amazon’s 2nd biggest purchase ever. Just because companies have super-deep pockets doesn’t mean they are the drunken sailors on leave the media fantasizes about.

So to repeat before I go… this kind of merger has not only never worked, but really, it’s never happened. And it should not happen because history tells us that the combined company will be smaller than the 2 separate companies, not bigger.

And Paramount has been operating under Ellison for 1 month and 8 days. And he is already looking around for some hot, fresh action.

This is not a James Bond movie.

Until tomorrow…