We all spend our time these days in an endless flurry of conversation about The Future or as some have mislabeled it, The Streaming Wars. And thus, theatrical. And thus, cable/satellite television. Etc.

I have actually seen the tide turning back to sanity this week with pieces I have seen about how streaming may not be the business panacea that people thought (it isn’t, never was, but it is the future, so deal with that) and how Netflix, for all its might, seems stuck at owning about 10% of the hours of screentime now (which is astonishing, but begs the question of whether they are now mature and should be managed differently… which they already have started, but not told us all directly) and how movie theaters are not suffering because people won’t go see comedies or dramas, but because distributors aren’t putting comedies and dramas in theaters.

If you have followed me, you know these are all positions I have written about for a year or longer. But the point of this is not to pat myself of the back.

In the current conversation, I find that in the conversation of legacy content delivery, the ongoing evolution of streaming and whatever is happening to theatrical, there is a seriously flaw in some broad assumptions and some key realities that almost always go unmentioned.

So, a trio of columns this week:

Assumptions - Episode One: Theatrical, An Old Hope

Assumptions - Episode Two: Linear Television, Decision-Free Strikes Back

Assumptions - Episode Three: Streaming, Return of the Bundle

Assumptions, Episode One: Theatrical

1. Theatrical Was In Serious Trouble Before COVID

False. 2019 was the 3rd highest grossing domestic year in history and the #1 worldwide grossing year in history.

2. The Theatrical Business Is All Big-Budget IP

In 2019, there were 17 movies released that cost over $125 million. They represented about $16 billion of the $40 billion worldwide gross. An outsized amount to be sure… but not “everything.”

3. Big Budget IP movies can be the nearly-exclusive driver of theatrical exhibition and exhibition will thrive.

Exhibition is a small margin business, no matter how obscene the cost of popcorn. There is not enough big IP in any year to support the brick & mortar businesses.

Realities

1. The number of movies, of all kinds, in theatrical release has dropped precipitously.

In December 2021, just 10 movies opened on 1000 screens or more. In December 2019, there were 12.

But it gets worse one step down. In Dec 2019, 19 films opened on between 100 and 999 screens. This last December, 7.

In November, it was 9 1000-screen openings in 2021 and 16 in 2019. 7 100-999 opens in 2021, 23 in 2019.

The “missing” movies are not just contributors to a higher gross, but they increase the chances of an outlying hit that contributes even more.

2. Holdover business matters.

In December 2019, movies that opened in December and grossed $100,000 or more accounted for $750.4 million at the domestic box office that month. Holdovers that opened before December added $395.2 million.

In December 2021, movies that opened in December and grossed $100,000 or more accounted for $765.1 million at the domestic box office that month. Holdovers that opened before December added $152.9 million.

Yes, the Spider-Man story is huge and powered these monthly numbers without much help. But one has to look beyond this and see that the $242 million less that came from holdovers this December (one month!) is a massive negative hit to exhibition.

The December holdover business in 2019 was 35% of the overall gross. This December, it was 17% of the overall gross.

You can see this from a different direction in November, comparing the same 2 years.

In November 2019, movies that opened in November and grossed $100,000 or more accounted for $752.4 million at the domestic box office that month. Holdovers that opened before November added $203.8 million.

In November 2021, movies that opened in November and grossed $100,000 or more accounted for $392.6 million at the domestic box office that month. Holdovers that opened before November added $129.3 million.

As you can see, the November holdover business in 2019 was 21.3% of the overall gross. This November, it was 25% of the overall gross.

Why did November do better than 2019 in this stat? Because October was an unusually loaded month this year, with 4 expected strong openers on the docket when the month usually has 2.

The disparity in the next month’s holdover would have been even greater had October 22 opener Dune been release theatrical-first, leading to a better hold. After doing $69 million in October, it managed only $33 million in November. In 2018, the October 5 opener A Star Is Born added $39m in November.

So both quality and quantity matter. In the current situations, not enough new films are going into theaters to support either kind of win, unless you get Spider-Man lucky.

3. Movies that succeed have succeeded shockingly like they did pre-COVID.

The only key statistical difference amongst movies that have grossed between $50 million and $150 million in 2019 and 2021 is in how many movies in this category were released into the market.

This is the most surprising stat I have wandered into for this piece.

There were 38 movies that grossed between $50m and $150m in 2019. There were only 18 in 2021.

The average opening for these films?

$26.5m in 2019.

$26.7m in 2021.

The percentage of the total domestic gross coming from opening?

2019, 31.2%.

2021, 32.9% (and likely to decrease as the December titles add more this month and next).

The average total domestic gross for these films?

$84m in 2019

$83m in 2021 (and growing)

Almost identical.

The total domestic gross for this category of film?

2019, $3.2 billion.

2021, $1.5 billion

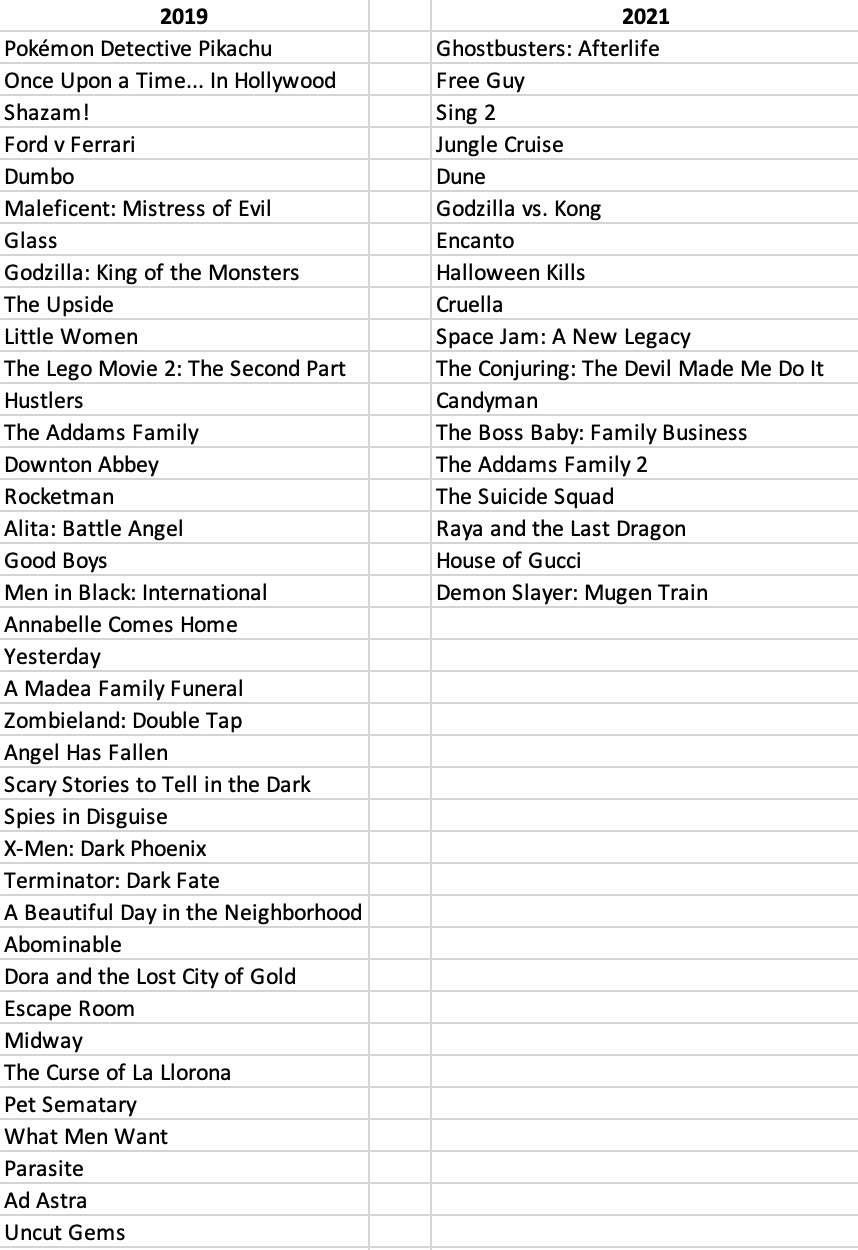

Of course there are other factors besides the number of films being put into theaters that, in detail, lead to this disparity. But take a look at the list of films from both years… I don’t see a big disparity or price, quality or genre in the kind of movies that makes up each year’s output, except in quantity.

Honestly, I am shocked by these facts. One could make all kinds of arguments about why they should be discounted. (One big one is that they are domestic only… but that is for another day.)

Whenever you take it from these broad figures to specific movies, it’s not quite as clear and getting cocky about one film’s future ecomes very nerve racking. No puffed out chests about what any movie will do. But the constant hum of negativity from people who are avoiding all the details that are in any way positive… that’s just crap.

The argument that a company should value any given piece of content as streaming sub bait over being a theatrically-launched revenue stream bait is not in any way illegitimate… assuming that the argument is factually based and no impulsive and/or ignorant of the range of facts.

So…

If you are okay with killing the exhibition business, this piece is asking you to think too much about something you really don’t care about.

If you are ambivalent about theatrical and are at peace with the idea of streaming taking over as 90%+ of the content delivery model, so be it.

But if you care about maximizing revenues… if you see the value to the theatrical window in creating passion about content… if you don’t want the entire industry shrunk to fit what will become “streaming wars: in 5 - 10 years… you need to support distributors not only pushing films into theatrical, but pushing a healthy number of films of all kinds into the theatrical window.

The future of streaming and theatrical really have little to do with one another, directly. Streaming will always be the final destination for theatrical movies. That is a given. The revenue from streaming, whether it is the only revenue or the 3rd or 4th window, will be part of the budgeting process and profit picture.

Theatrical, aside from stunt releases, will always be the first stop. And streaming, whether the first stop or the last, will always be the last stop. The value that can be measured at each step is how choices will be made.

The risk and the reward will always be greater with theatrical. But we are still at the very beginning of measuring each step on the revenue chain.

Until tomorrow…

Share this post