THB #234: Wall St x Hollywood = Madness

I have been churning on this piece about how insane Wall Street is when it comes to content companies for over a month. What I haven’t been able to do is to figure out to express my general unease with the current generation of industry leadership chasing stock price over building their core businesses when it is completely clear that Wall Street has no real interest in the realities of the industry.

A mouthful.

Next week, we enter this industry’s quarterly 20 days of stock market madness, as financial reports get released by the 5 major players whose businesses are closely enough connected to content that they can be fully read.

Netflix - Oct 19

Comcast - Oct 27

Paramount - Nov 2

WBD - End of Oct/Early Nov

Disney - Nov 8

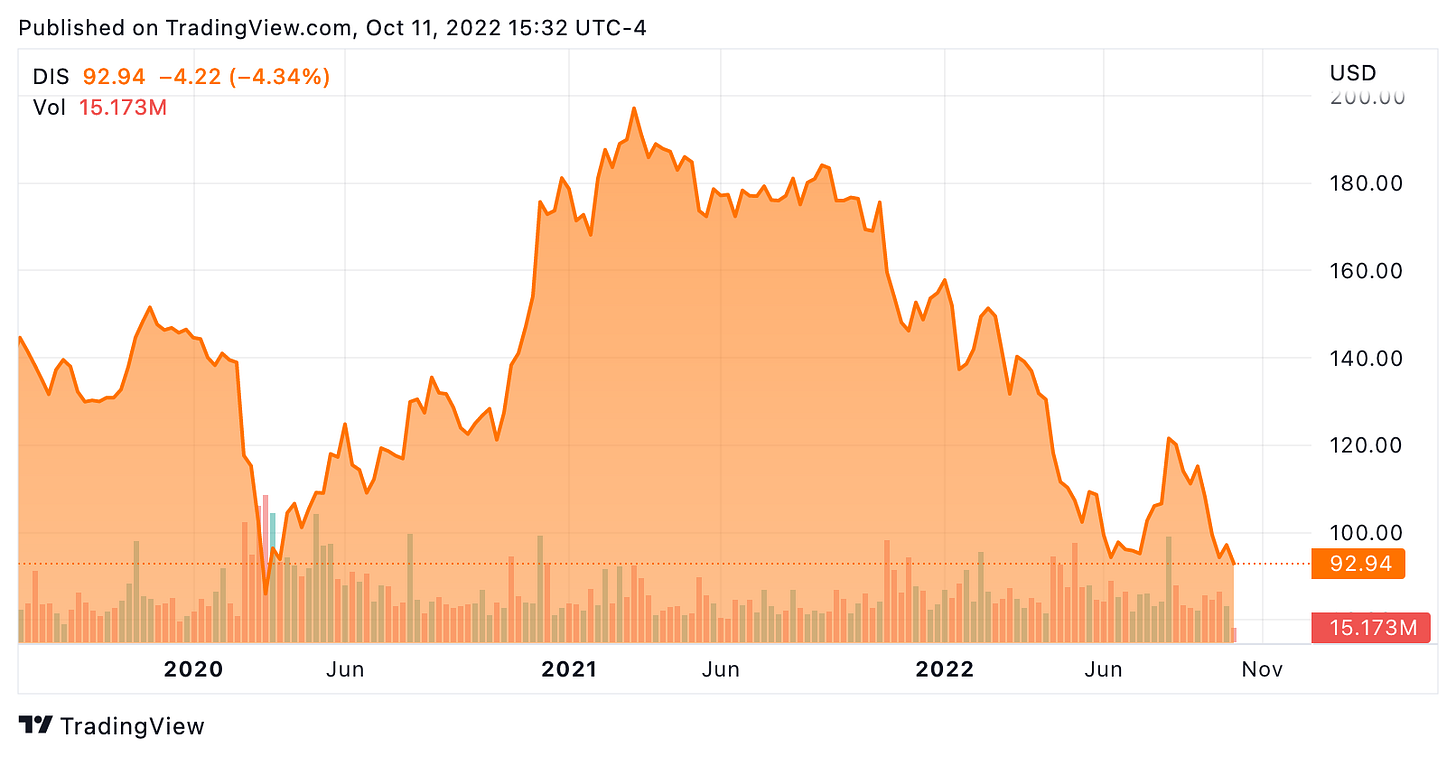

What got me moving on this story again today is noticing that Disney is near it’s stock price low since the very beginning of the COVID shutdown in March 2020.

WTF?

You can see here that at 12:34p pacific today, the stock was at $92.94 and that the only lower mark was in the…

Keep reading with a 7-day free trial

Subscribe to The Hot Button by David Poland to keep reading this post and get 7 days of free access to the full post archives.